The very first requirement in a hospital is that it should do the sick no harm.

– Florence Nightingale

My brother-in-law is “petrified” of going to the hospital for a necessary appointment because he doesn’t want to catch the coronavirus.

– Dr. Ron Hochman, CEO of Providence, St. Joseph Health

Last Friday night over (zoom) cocktails with some friends the subject of the on-going crisis underway at our hospitals came up. The conversation wasn’t about ventilators or PPE. Rather it was about the collapse of elective procedures and non-urgent care, how much elective procedures subsidize the operating models of every hospital* (* a lot) and the corresponding liquidity crisis in the system. In fact – there is currently an estimated net revenue decline of $1.44 billion PER DAY nationally because of Covid19. Thats per day, every day.

*Yes, this conversation is pretty deep for happy hour but remember we have no sports (kids or professional) to discuss during quarantine. (One small benefit of quarantine: diversify the cocktail hour conversations away from the same topics over and over again.)

I sent a note to my colleagues who specialize in the HealthCare vertical to open an internal dialogue. What are we seeing at our customers and how can we help? I learned a lot. I have a brother who works at a hospital in SLC and told me his hospital was significantly cutting back on hours. That surprised me. But after some research it didn’t. Furloughs and layoffs in our hospitals across the country are everyday headlines.

By Sunday I was reading the 10Ks for HCA and by Tuesday I found myself listening to a webcast featuring 2 hospital CFO’s. It was fascinating. Hospital volumes have dropped dramatically and so quickly since the end of February that many health system financial executives are scrambling for sources of cash.

Its one thing to read a news report or blog, but it sinks in more viscerally when you hear it directly from a finance practitioner (the CFO’s on the call) They were talking about emergency liquidity steps to shore up their cash positions, the short term changes required, the structural changes already forecast and what kinds of partners they needed.

https://flashreportmember.kaufmanhall.com/national-hospital-report-april-2020?

Net: As a country, we clearly need our hospital capacity. However we got to this point, we should all do everything we can to help those running our hospitals and providers. This crisis will accelerate Telehealth & Digital Transformation in HealthCare. It will change the status quo on partners, operating and financing strategy.

A few interesting learnings / data points:

#1 – Hospitals are a huge employer. You knew it was big, but >5 % of the workforce and >7 Million people?

In the US, Healthcare also accounts for 18% of U.S. Gross Domestic Product. Hospitals account for a third of that and they employ more than 7 million people. (that is ~5% of total workforce)

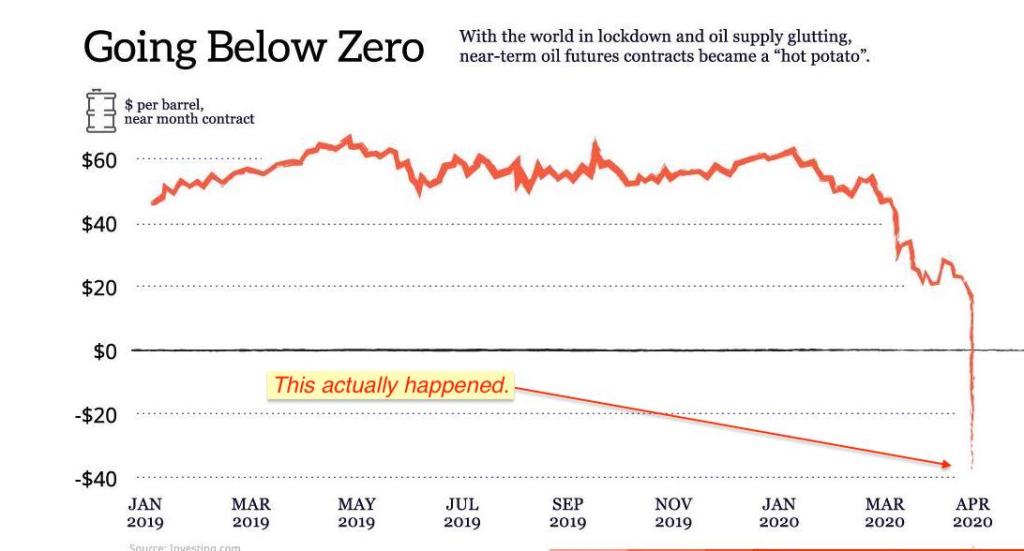

COTD #1 ( Chart of the Decade)

Chart of the Decade* (*so far)

If you like charts, the Covid19 pandemic is providing raw material that will last the rest of my career and beyond. I know it’s early in the year, but we may have a winner for “Best Use of Data Visualization” or “Showstopping Chart of the Year”. The effect of this chart used on the real estate of the NYT’s front page will be very difficult to beat.

#2 – Pandemic planning was part of provider risk assumptions

From HCA Annual report (last 3 years – identical language):

“The emergence and effects related to a pandemic, epidemic or outbreak of an infectious disease could adversely affect our operations.“

If a pandemic, epidemic, outbreak of an infectious disease or other public health crisis were to occur in an area in which we operate, our operations could be adversely affected. Such a crisis could diminish the public trust in health care facilities, especially hospitals that fail to accurately or timely diagnose, or are treating (or have treated) patients affected by infectious diseases. If any of our facilities were involved, …., patients might cancel elective procedures ….Further, a pandemic, epidemic or outbreak might adversely affect our operations by causing a temporary shutdown or diversion of patients, by disrupting or delaying production and delivery of materials and products in the supply chain …..the potential emergence of a pandemic, epidemic or outbreak is difficult to predict and could adversely affect our operations.

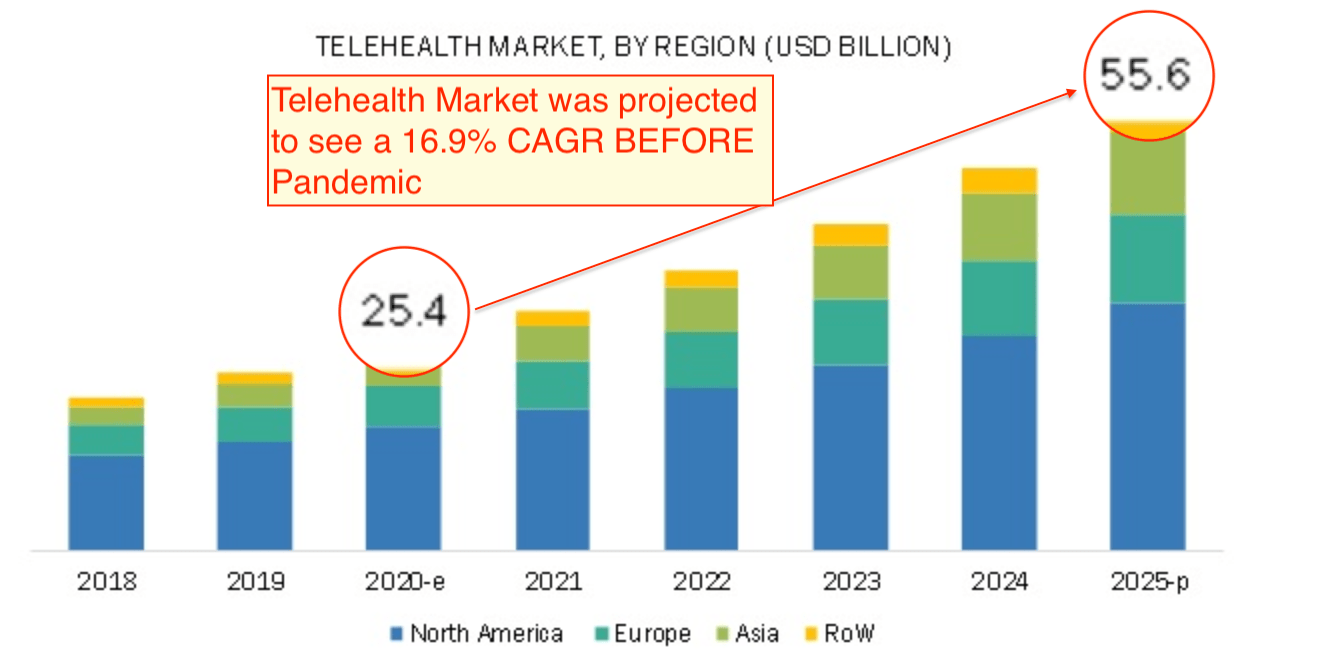

#3 – Telehealth was forecast to Double BEFORE the Pandemic

COTW #2 (Chart of the Week).

Telehealth Revolution* Its still called “tele-health”? This revolution has been forecast for so long the advanced technology that the revolution is named after is the telephone. This “revolution” has been slow to materialize.

That said – one CFO on the call shared they went from 25 in Feb to 25,000 in April! The forecast below was before Covid19.

Driven by a) shortage of physicians, rise in geriatric patients, large # of rural and underserved population, prevalence of CHRONIC conditions, cost benefits and Finally (and most importantly) easing of Government Regulations!!

https://www.fiercehealthcare.com/tech/industry-voices-will-remote-healthcare-outlast-covid-19

“….many of the rules and regulations that hindered the growth of remote care were removed. To name a few: Medicare now reimburses remote care, physicians can practice across state lines, pharmacists can upskill and perform more clinical-grade services and more.

Just one of these would have been a game changer. All of them together signal a revolution underway.

This new, and for now temporary, state of regulation unleashed the power and promise of remote care. Millions of Americans are now receiving care and interacting with medical practitioners online and in full clinical utility. Over a billion virtual healthcare interactions are expected by year-end. For the first time, the question is not, “Why do it remotely?” It’s, “Why do it onsite?”